- The Walt Disney Company Its Diversification Strategy In 2014 2018

- The Walt Disney Company Its Diversification Strategy In 2014 2016

- The Walt Disney Company Its Diversification Strategy In 2014 Called

- The Walt Disney Company Its Diversification Strategy In 2014 Video

“The Walt Disney Company: Its Diversification Strategy in 2018

Read Case Study #9 “The Walt Disney Company: Its Diversification Strategy in 2018″ and respond to the attached questions, Please provide a Competitive Strength Assessment as part of your response with a detailed explanation of the assessment’s key points. THIS IS VERY IMPORTANT ” There should always be a reference list provided for submissions. Only those works cited should be listed as a reference. Cited statements in support of your responses are required. Statements like I think, or I believe, without details in support from the case study are not credible. Outside source materials are encouraged to be used. However, they are to be used to support the response you have or to make a contrary point to the case study conclusions. The predominant information should be from the case study. Sources outside of the case study are not to be used in place of the analysis work of the case study itself.

Roy from continuing to build on his brother’s dream. In 1971, Walt Disney World opened its doors in Florida. Roy Disney passed away in late 1971. At that point, control of the company passed to Donn Tatum, followed by Card Walker and then Ron Miller (Walt’s son in law).6 Disney continued to expand by adding additional theme parks and media. Case #7 the Walt Disney Company Its Diversification Strategy in 2014 October 18, 2017 Author: M Syafrin Hady Putra Category: The Walt Disney Company, Walt Disney Parks And Resorts, Disneyland, American Broadcasting Company, Walt Disney Report this link.

There are several benefits offered by the The Walt Disney Company Its Diversification Strategy In 2014 Case Study binary options The Walt Disney Company Its Diversification Strategy In 2014 Case Study trading to its traders. The traders are given the opportunity to do binary trading even for free with the help of the free demo accounts. For this case study, you will choose either Case 10 – Chipotle Mexican Grille or Case 22 – The Walt Disney Company: Its Diversification Strategy in 2014. These cases are interesting because they demonstrate companies that are examples of sustainability despite tough economic conditions.

A full response to the case study questions is to be submitted. Submitting a list of items without a detailed explanation of the significance of the information is a non-response. All questions require an explanation. Often you will see that asked directly if not provide one as a standard procedure.

Question: Read The Walt Disney Company: Its Diversification Strategy In 2018 Case. What Is Their Central Problem And Mission? PESTEL Analysis 3. Competitor Analysis 4. Value Chain Analysis 5. Resources & VRIN Analysis 6. Industry Analysis/ Competitive Strength Matrix 8.

Large amounts of information are not to be copied and pasted into your work even if cited properly. Table, graphs, pictures, are allowed if cited. Other information has to be paraphrased and take in portions to make your point.

A Competitive Strength Assessment (CSA) must be included with all case study submissions. An explanation of that assessment must be submitted as well. Note the instructions on this point. I Will upload The explanation of how to properly construct a CSA. What are the significant findings? How does your assessment impact the company’s ability to gain or maintain a competitive advantage? How will it impact the future of the company?”

Sample Solution

The Walt Disney Company Its Diversification Strategy In 2014 2018

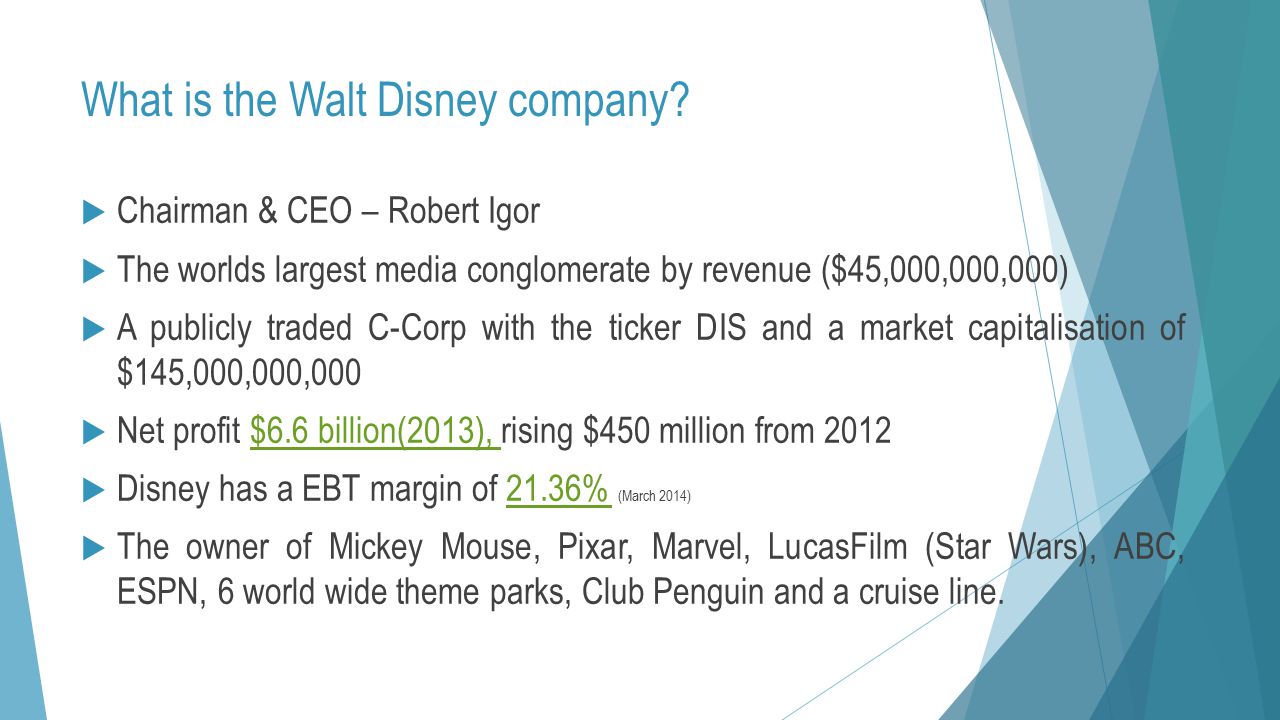

The Walt Disney Company’s diversification strategy can be classified as related linked. Less than seventy percent of the firm’s revenue comes from any one business and the businesses share only a few links across them. Disney is in the theme park, movie/TV production, TV broadcasting, and merchandising industries. Several of these businesses market the same characters across them such as Mickey Mouse. ESPN is in the TV production and TV broadcasting industry and is linked to other Disney companies like the Disney Channel .

The chapter points out that diversification within a company is not necessarily always positive for investors. Most recent research shows that diversified companies create less value than focused firms. The Walt Disney Company is a great example of diversification not providing as much value. Currently ESPN is a financial drain to Disney. The Disney parks are doing very well, but the company’s stock price is not reflective of that due to ESPN losing money. If Disney limited its core businesses, it would be performing financially better today for its investors. As the book points out in this chapter, a company should only diversify into activities that it has strategic advantages that it can exploit to create value. It makes sense for Disney to run businesses that help promote its theme parks like the Disney channel, merchandising, and its traditional movies do, but venturing beyond has proven to be a financial burden.

The Walt Disney Company Its Diversification Strategy In 2014 2016

Sources:

Revenue of the Walt Disney Company in the fiscal year 2015, by operating segment (in billion U.S. dollars): http://www.statista.com/statistics/193140/revenue-of-the-walt-disney-company-by-operating-segment/

The Walt Disney Company Its Diversification Strategy In 2014 Called

Barney, J (2011). Gaining and Sustaining Competitive Advantage (4th ed). Upper Saddle River, NJ: Pearson.

The Walt Disney Company Its Diversification Strategy In 2014 Video

When Success Isn’t Enough: What’s Holding Back the Disney Parks: http://www.themeparkinsider.com/flume/201602/4950/